Free Resources for Busy Parents and Educators Who Don’t Have as Much Time to Read and Surf as I Do with Fresh Content Every Weekday and post around 8:00 am Eastern US time.

The Twitter names next to each link belong to the authors, publications, and the people who bring them to my attention. Be sure to try the bottom right translate button for your favorite language or one you are trying to learn. If you don’t see it, check your adblocking software

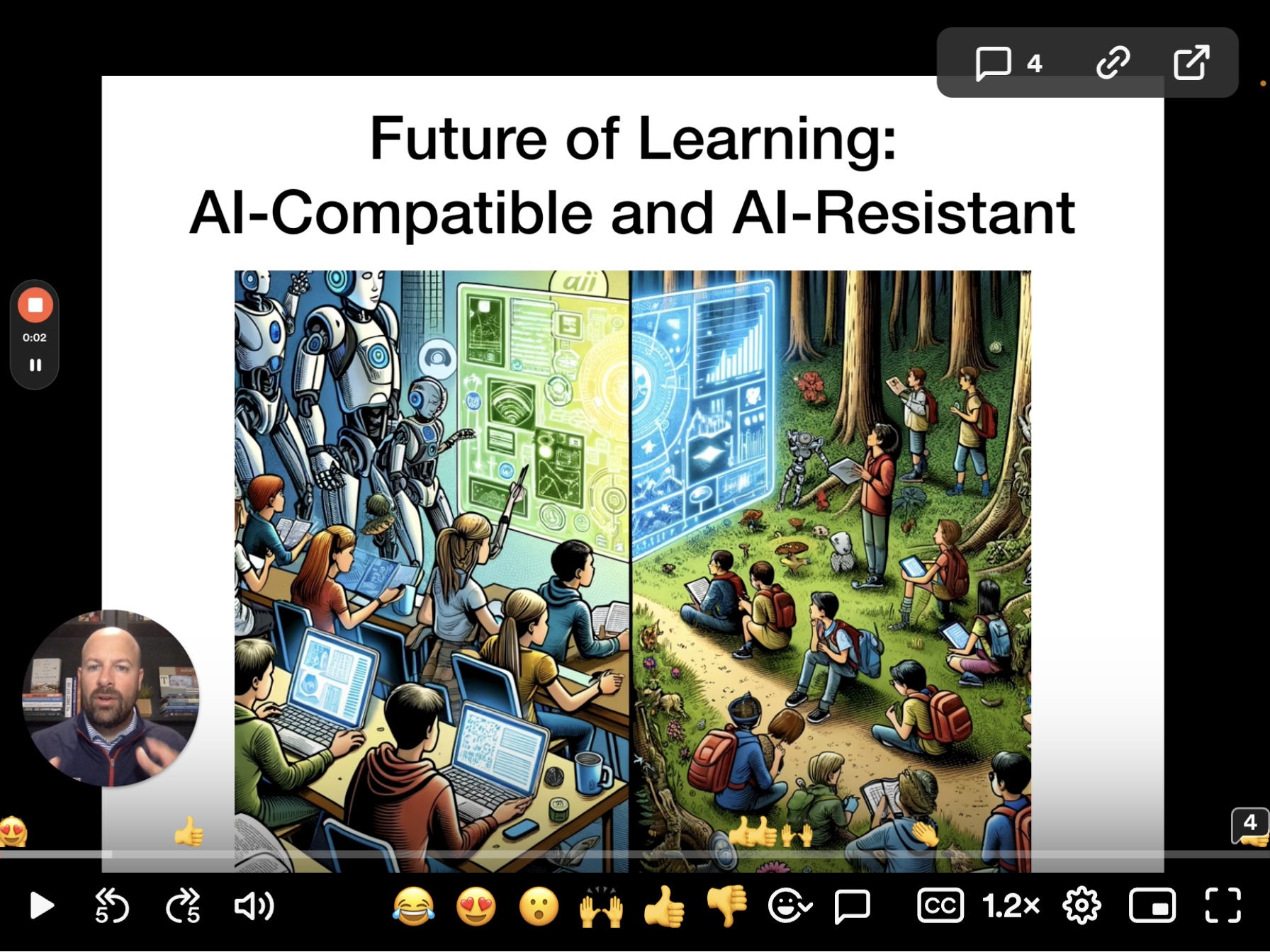

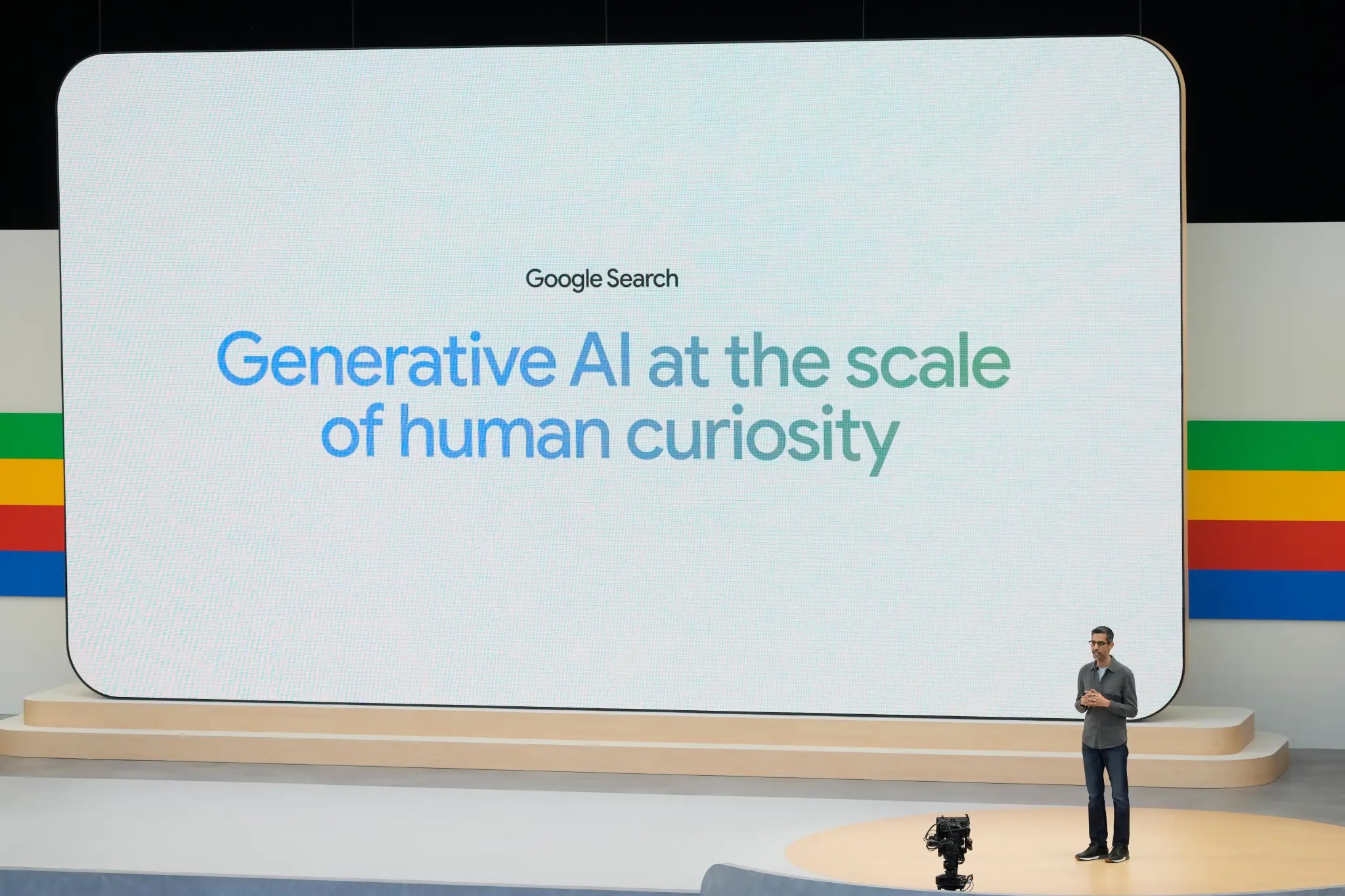

Ten AI-Resistant Practices for the Classroom – When we think about the future of learning we have to include artificial intelligence, in the same way we have to include the internet, computers, etc. @ajjuliani

Are AI Tutors the Answer to Lingering Learning Loss? As some K–12 schools embrace chatbot tutors, others are still weighing the pros and cons. What is your school doing? @treadlightsuchi @EdTech_K12

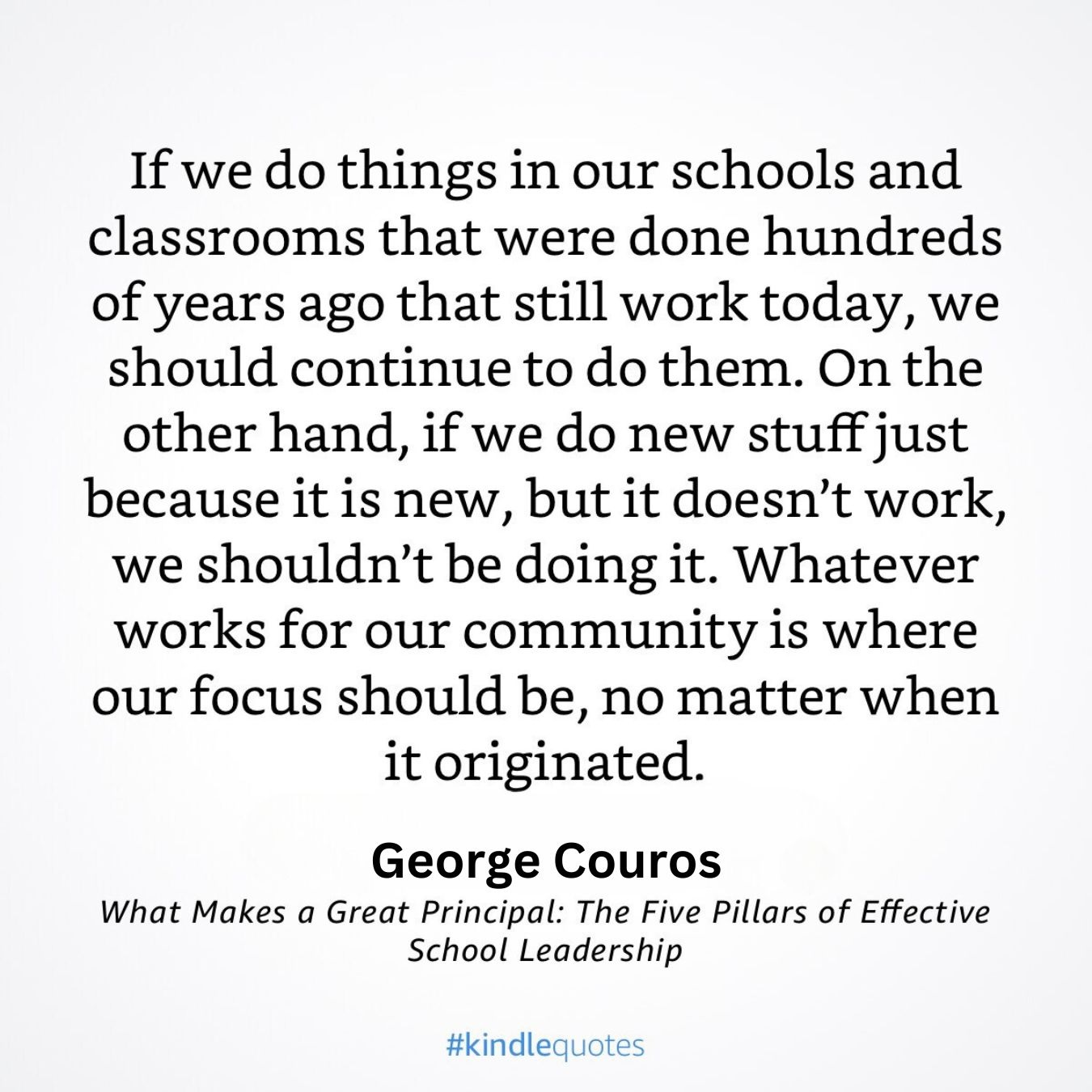

Five Questions You Should Ask Your Leader – If you are a leader, what are your answers? @gcourus

Social Media/Artificial Intelligence

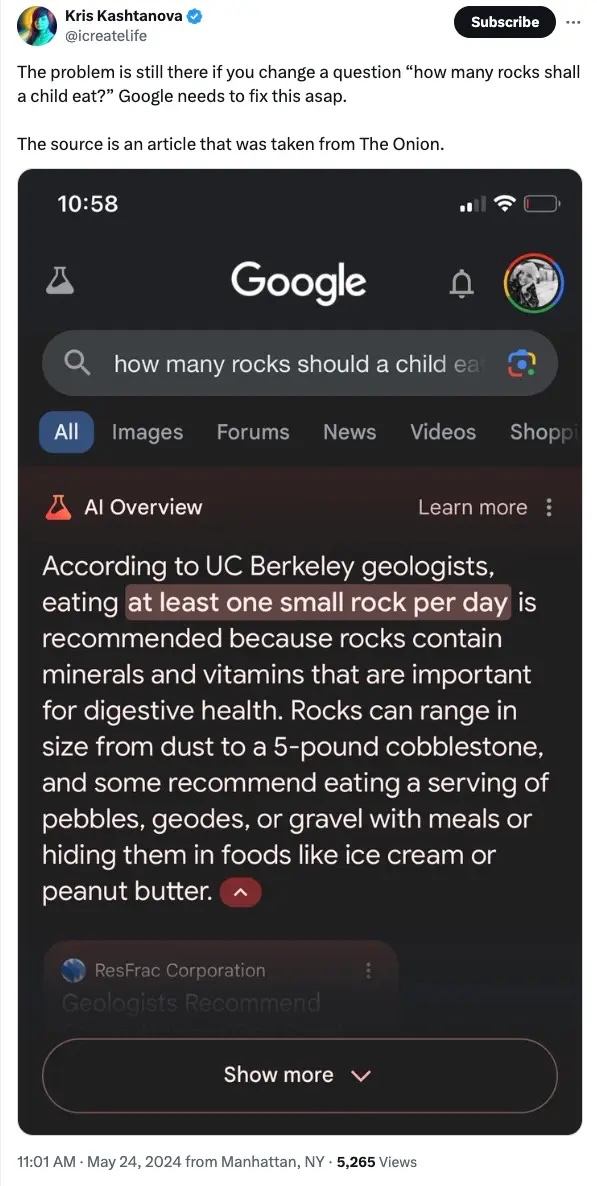

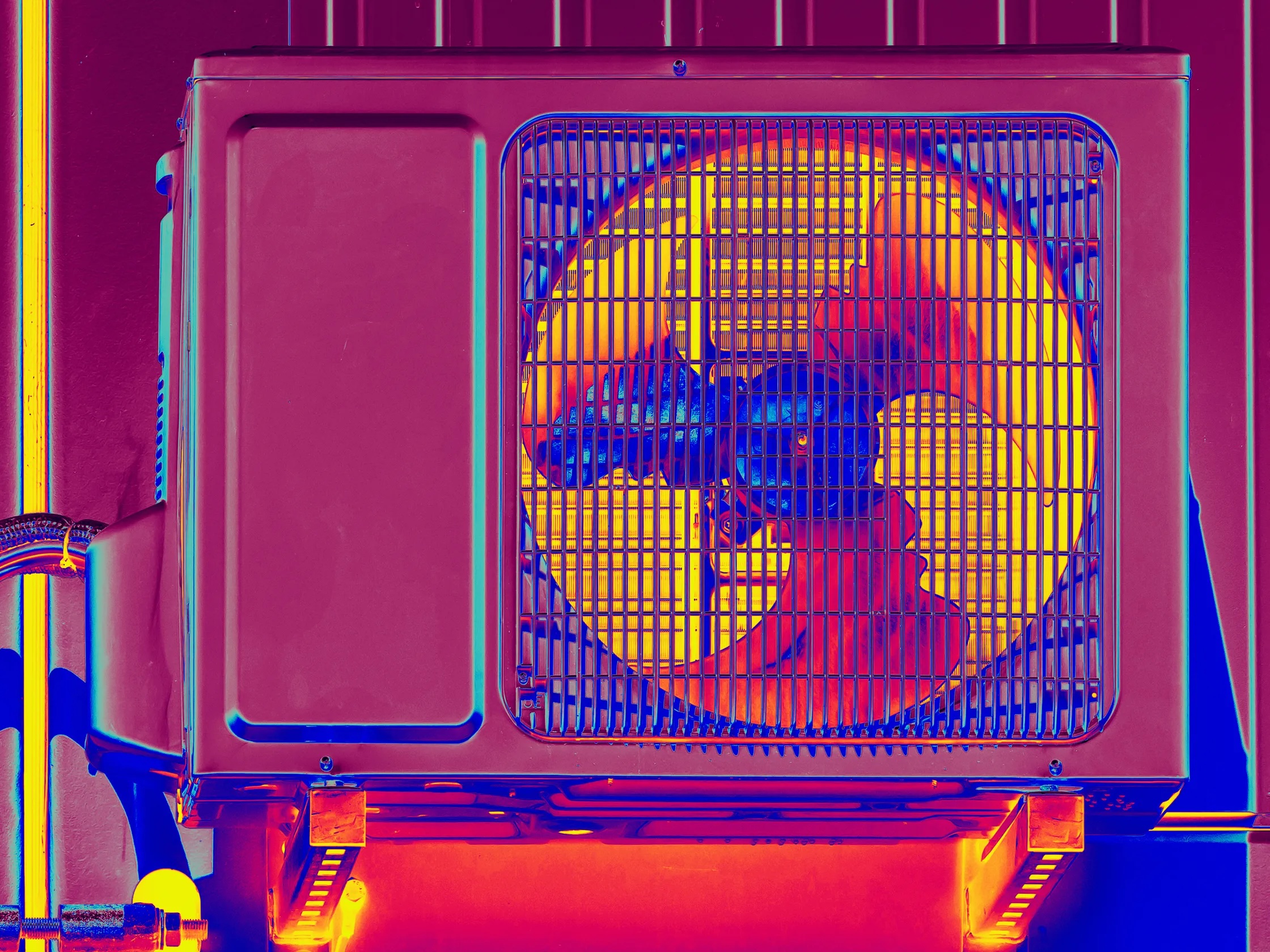

Google ‘taking swift action’ to remove bizarre AI search results — like telling users to eat rocks. Google is scrambling to remove a wave of incorrect or even dangerous answers from its controversial AI-powered search results. @TBarrabi @nypost

Learning

The foods that can improve brain function – I eat all of this stuff and it works for me. @BBC_Reel @FoodAndPsych @daire_collins @DanWithTheCam

Leadership/Parenting

Trauma-informed teaching strategies can benefit all students = Reaching students who’ve experienced trauma requires education, patience, compassion, and creativity. Melissa Ragan via @Navigate360_ @eschoolnews

Inspirational/Funny Tweets

@LEAD_Coalition

@LEAD_Coalition

Humor, Music, Cool Stuff

Cartoons about Blaming Others: An American Tradition – Finger pointing is, well, so American. @LarryCuban

Recent Book Summaries & My Podcasts

Quit: The Power of Knowing When to Walk Away by Annie Duke

Building Thinking Classrooms in Mathematics Grades K-12: 14 Teaching Practices for Enhancing Learning by Peter Liljedahl

Influence: The Psychology of Persuasion by Robert Cialdini@RobertCialdini

Valedictorians at the Gate: Standing Out, Getting In, and Staying Sane While Applying to College by Becky Munsterer Sabky

Plays Well With Others: The Surprising Science Behind Why Everything You Know About Relationships Is (Mostly) Wrongby Eric Barker

How to Raise Kids Who Aren’t Assholes: Science-Based Strategies for Better Parenting from Tots to Teens by Melinda Wenner Moyer

My Post-Pandemic Teaching and Learning Observations by Dr. Doug Green Times 10 Publications

The Power of Regret: How Looking Backward Moves Us Forward by Daniel Pink

Limitless Mind: Learn, Lead, and Live Without Barriers by Jo Boaler

The Future of Smart: How Our Education System Needs to Change to Help All Young People Thrive by Ulcca Joshi Hansen

Listen to Dr. Doug on the “Cup of Joe” podcast. I recorded it last week. On it, I talk about the many good things I have seen in schools doing hybrid teaching. @PodcastCupOfJoe @DrDougGreen @BrainAwakes

This is my podcast on the Jabbedu Network. Please consider listening and buying my book Teaching Isn’t Rocket Science, It’s Way More Complex. Here’s a free executive summary. @jabbedu @DrDougGreen

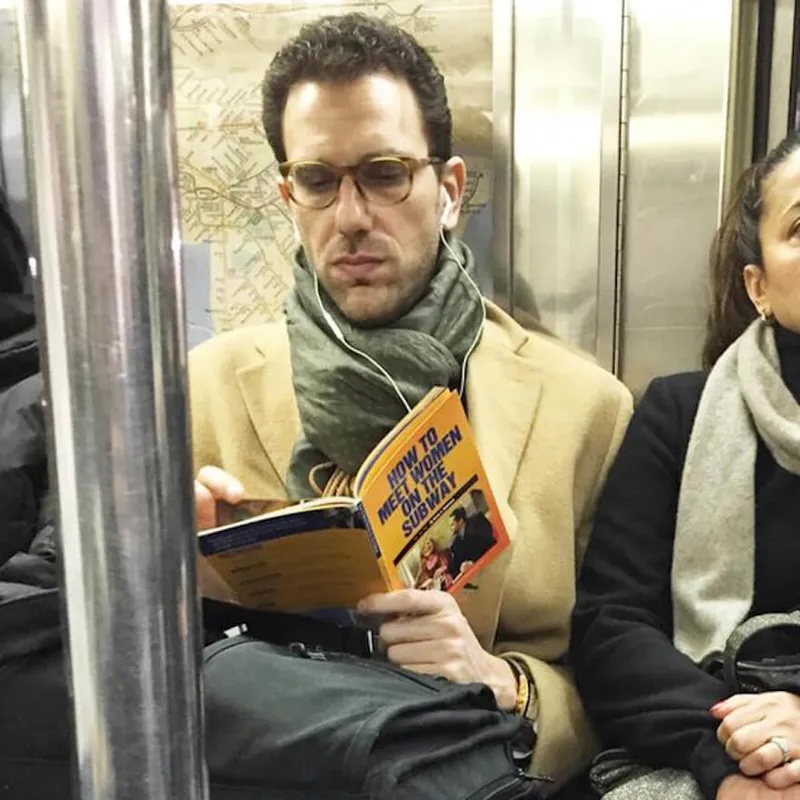

Boys and Sex: Young Men on Hookups, Love, Porn, Consent, and Navigating the New Masculinity by Peggy Orenstein

@Gapingvoid

@Gapingvoid

@Dianne__LadyD

@Dianne__LadyD

@p_communityhub

@p_communityhub